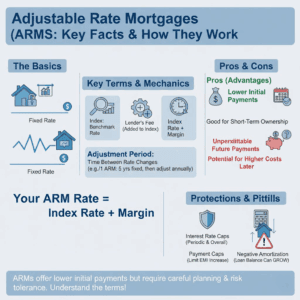

Adjustable rate mortgages, or ARMs, are mortgages with varying interest rates that are usually determined by performance of benchmark indexes. As the index rate changes, your rate of interest will be adjusted periodically.

How ARMs Work: Key Terms You Need to Know

- Index- The index is essentially a guide that lending institutions use to measure changes in the interest rates. All ARMs are linked to specific indexes.

- Adjustment period- This is the time between two interest rate adjustments. Banks often describe ARMs with numbers and you would’ve probably seen figures like 3-1 or 5-1. Here the first number in each set represents the initial period during which your rate of interest will remain fixed. The second number shows the adjustment period. It displays how often the bank will adjust your rates.

- Margin- Your bank has to recover the cost of lending money to you. They should also be able to make a profit. This is the margin. Banks add the margin to index rates to calculate your adjustable interest rate. The margin does not normally change during the entire tenure of the home loan.

What are the advantages of an adjustable mortgage?

During the initial stage, adjustable mortgages have relatively lower interest rates than fixed rate mortgages. A lower interest rate means lower EMIs. This might help you to get a larger home loan.

After this initial period, however, the interest rate will change. It may even go up, depending upon

- ARM Indexes- You can’t determine the index a bank uses. However, you can select a lender that uses the index of your preference. Try to find an adjustable mortgage linked to a benchmark index that has performed consistently well over the last few years.

- Interest rate caps- ARMs usually come with rate caps. The rate cap limits the amount of interest that banks can charge. Two kinds of rate caps are associated with adjustable mortgages. A periodic rate cap determines how much your rate of interest can increase between two adjustment periods. Some ARMs don’t have periodic caps. All ARMs have overall caps. They determine how much your rate of interest can increase during the entire tenure of the loan.

- Payment caps- Payment caps determine the amount by which your EMI can increase during each adjustment. If an ARM comes with a payment cap, it is unlikely to have a periodic rate cap.

- Carryovers- In some cases, the index may have gone up, but your interest didn’t rise beyond a certain amount due to a rate cap. In this case, the lender can carry over the amount of interest to the next adjustment period.

- Amortization- Amortization occurs when your EMI covers a certain percentage of the principal amount in addition to the interest due. Negative amortization, on the other hand, takes place when your monthly installment does not cover the interest due. The unpaid amount will be added to the principal amount. This is a huge trap.

How Long Should You Stay in Your Home with an ARM?

Well, if you are planning to sell your home in the next few years, you don’t have to worry about a hike in interest rates. You can convert some adjustable mortgages to fixed rate mortgages. However, conversion fees are usually very high.

What are the advantages of an adjustable mortgage?

During the initial stage, adjustable mortgages have relatively lower interest rates than fixed rate mortgages. A lower interest rate means lower EMIs. This might help you to get a larger home loan.

After this initial period, however, the interest rate will change. It may even go up, depending upon existing market conditions.